Managing Subrecipient Risk: Best Practices for Federal Grants

One of the most critical aspects of federal grants management is subrecipient risk assessments and monitoring. Such practices safeguard against funds...

The issue of pay inequity in the nonprofit sector is one that has long been acknowledged, yet rarely discussed. Nonprofits often operate on tight budgets, which limits their ability to address pay inequities. In addition, many employees are passionate about their work and may accept lower salaries to support the organization's mission. This can create a culture of underpaid professionals within the sector, particularly among women, who are often just one or two paychecks away from being in the same situation as the constituents they serve.

Organizations in all industries have faced increasing pressure in recent years to be more transparent about salary information, both during the job application process and within the workplace. According to a 2022 Visier study, 79% of employees want some form of pay transparency, 68% say they would switch employers for greater pay transparency, and 32% want total transparency.

Colorado was the first state to implement a legal requirement for employer pay transparency in 2021, mandating that salary ranges be disclosed in all job advertisements. Similar legislation requiring employers to comply with pay transparency requirements has been enacted in seven states and six localities. Additionally, 21 states and 20 localities have established statewide bans on requesting current salary or salary history from job applicants, and the trend is growing. You should regularly check your state department of labor’s website and your city’s official website to stay informed about the pay transparency laws affecting your organization.

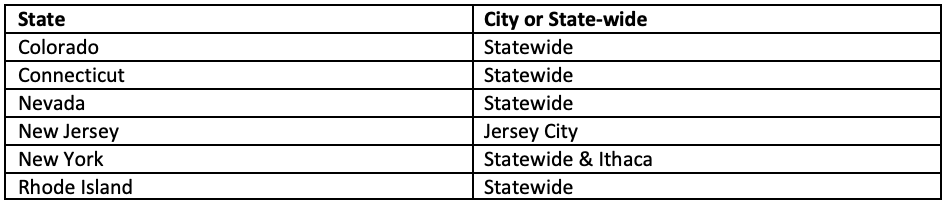

Salary History Bans

The most widely established pay transparency regulations prohibit employers from asking candidates about their salary history or current salary. These bans aim to decrease wage inequality and foster greater inclusivity in the workforce. The chart below lists states and localities that currently have salary history bans.

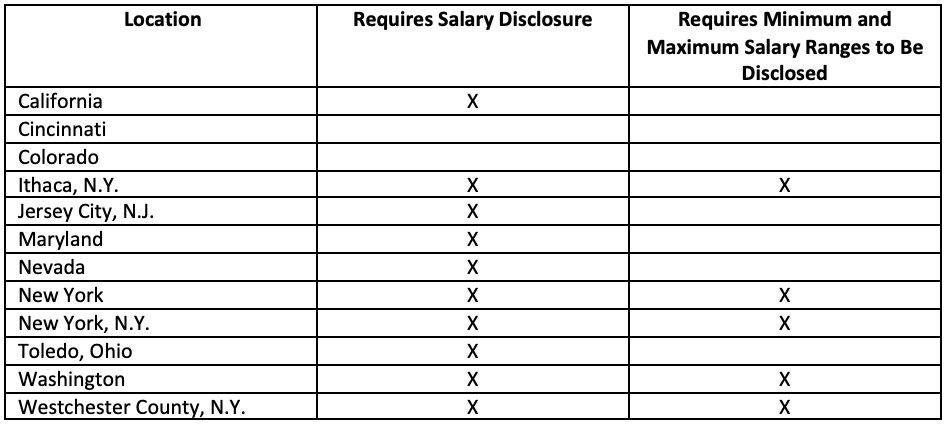

Disclosure of Pay Rate to Applicant

With Colorado leading the way, seven states and six localities have implemented distinctive legislation on employer pay transparency with the primary provision of mandatory disclosure of salary ranges in job postings, which may encompass the job's target pay or other relevant salary information.

Salary transparency and disclosure initiatives are designed to promote trust between employers and job seekers and to demonstrate a company's dedication to equitable pay in the workplace. “Most employees (91 percent) who believe their organization is transparent about how pay decisions are made also said they trust that their organization pays people equally for equal work regardless of gender, race and ethnicity,” per the Society for Human Resource Management.

The chart below lists states and localities that have salary disclosure requirements along with those that have established salary minimum and maximum disclosure requirements.

Disclosure of Pay Rates to Employees

Another typical pay transparency provision requires employers to disclose salary ranges to existing employees. This could include disclosing salary ranges to employees who are being considered for promotion or transfer, as well as providing employees with the salary range for their current role upon request. These provisions are meant to promote transparency throughout all tiers of employment, enabling workers to understand their position's current pay expectations from the perspective of their employer.

The chart below lists states and localities with internal salary disclosure guidelines.

Regardless of the specific information involved, all of the disclosure requirements discussed above presume that your organization can readily supply the required information and has a formalized process by which this information is secured. As information is released to the public, there will likely be occasions where follow-up inquiries are made to provide further information and the process used to develop it. As the trend is growing in popularity, now is an opportune time to consider your preparedness for these disclosures and potential inquiries.

One of the most critical aspects of federal grants management is subrecipient risk assessments and monitoring. Such practices safeguard against funds...

Nonprofits have long relied on the generosity of donors and the dedication of volunteers to carry out their missions. However, recent trends indicate...

When selecting an audit firm for your non-profit organization, experience matters—especially experience with non-profits. The nuances of non-profit...