On April 26, 2024, the Department of Labor (“DOL”) published the Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees Rule (“Final Rule”), which will increase the minimum salary thresholds for bona fide executive, administrative, and professional exemptions under the FLSA. Effective July 1, 2024, the annual salary thresholds for these “white collar” exemptions will increase to $43,888 (from $35,568) and increase again on January 1, 2025, to $58,656 and the threshold for highly compensated employees will also increase from $107,432 to $132,964.

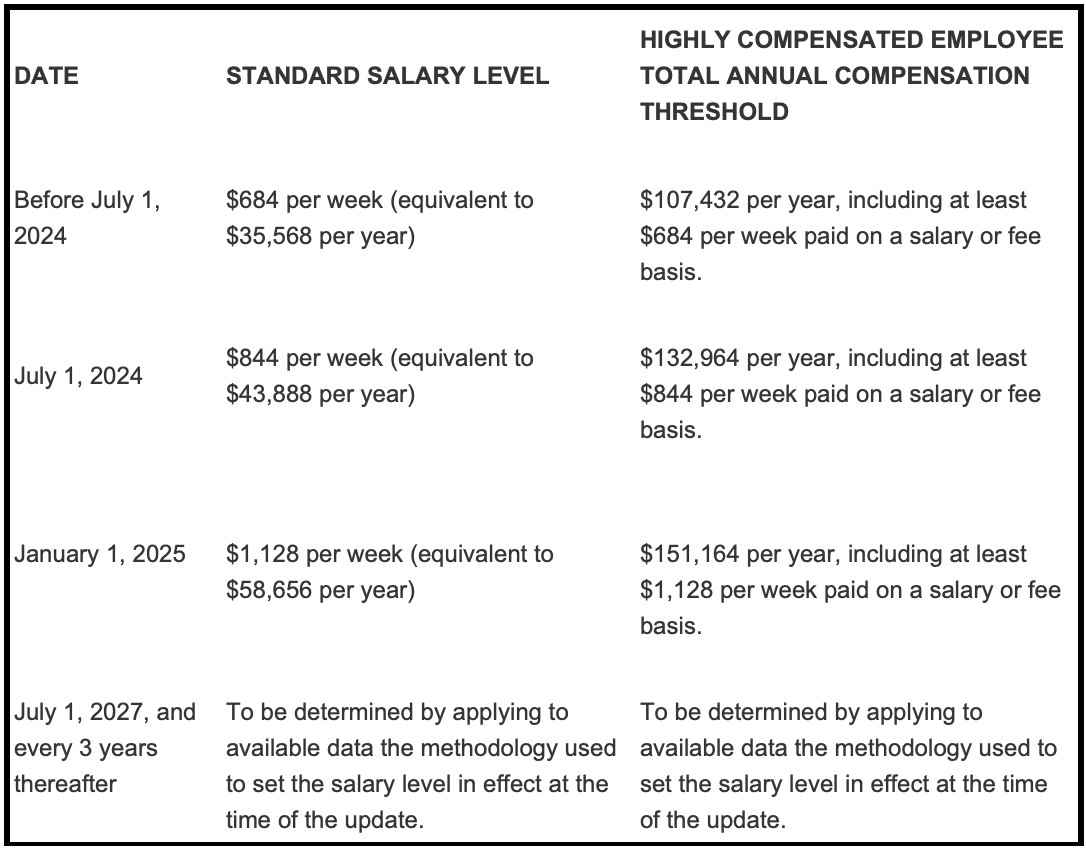

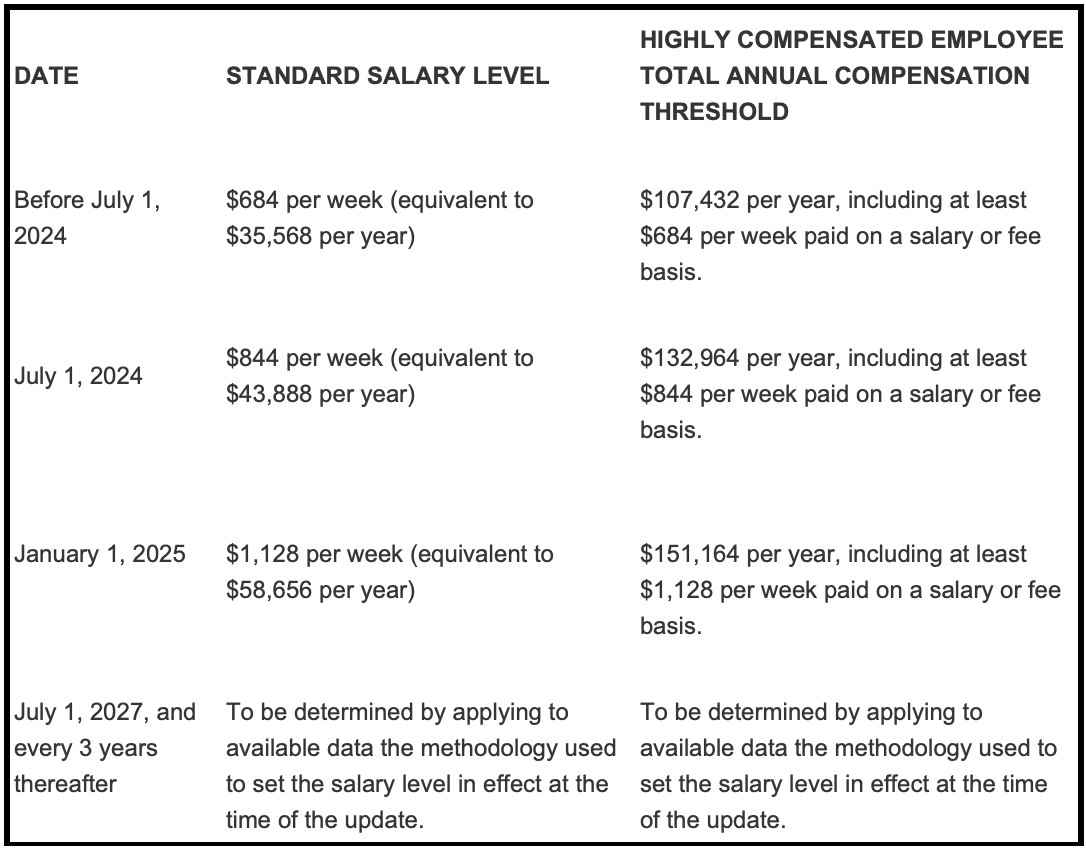

Key Dates and Changes:

The DOL published the below chart explaining the changes and their effective dates:

Key Takeaway

The significant increase in the salary level test for the white-collar exemptions will require employers to quickly identify and evaluate positions compensated below (or near) the new thresholds and decide whether to reclassify employees or raise their salaries. In making this determination, employers should look at the hours worked for those employees under the salary threshold to estimate the potential cost of paying overtime.

If you have any questions about how this change may impact you, please contact our Elevate team for assistance today.