You may be able to save more for retirement in 2019

Retirement plan contribution limits are indexed for inflation, and many have gone up for 2019, giving you opportunities to increase your retirement...

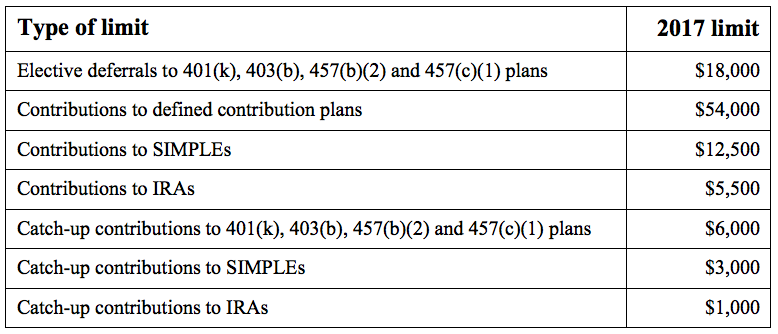

Retirement plan contribution limits are indexed for inflation, but with inflation remaining low, most of the limits remain unchanged for 2017. The only limit that has increased from the 2016 level is for contributions to defined contribution plans, which has gone up by $1,000.

Nevertheless, if you’re not already maxing out your contributions, you still have an opportunity to save more in 2017. And if you turn age 50 in 2017, you can begin to take advantage of catch-up contributions.

However, keep in mind that additional factors may affect how much you’re allowed to contribute (or how much your employer can contribute on your behalf). For example, income-based limits may reduce or eliminate your ability to make Roth IRA contributions or to make deductible traditional IRA contributions. If you have questions about how much you can contribute to tax-advantaged retirement plans in 2017, contact us at 1-866-287-9604.

© 2016

Retirement plan contribution limits are indexed for inflation, and many have gone up for 2019, giving you opportunities to increase your retirement...

The IRS recently announced the retirement plan limits for 2018. And while much has stayed the same, there are a couple notable changes.

1 min read

Tax-advantaged retirement plans like IRAs allow your money to grow tax-deferred — or, in the case of Roth accounts, tax-free. The deadline for 2017...